If you are an expat in Dubai, you may have trouble finding a bank to provide you with a personal loan. The process can be long and frustrating, but it is important to remember that the money you borrow is temporary. In the UAE, your personal loan will last no more than six months. If you are unable to make your monthly payments, you will be required to pay late payment charges, which can cost up to 2.5 percent of the amount of the loan. You should also consider your employment situation when looking for a bank to give you a loan.

The best way to find a personal loan in Dubai is to look online. There are various options available to apply for a personal loan in UAE, including applying in person or online. You can compare interest rates and other features to decide on which one is right for you. If you have bad credit, you may have a hard time obtaining a personal mortgage loan in Dubai. If you have poor credit, you can still find a bank in Dubai to offer you a personal loan.

The first step is to decide how much you can borrow. Personal loans in Dubai are generally unsecured, meaning that you can borrow money without providing any collateral. Because you can use them for whatever you want, you will find the interest rates to be affordable. A bank that offers personal loans in the UAE will have flexible repayment periods, and you can even apply for one without having collateral. You can also apply for a loan through your salary transfer bank, which makes it easy to pay it back.

Once you have chosen a bank, you will be required to repay the loan within 48 months. The interest rates are often higher than the maximum credit card rates. However, you will be able to enjoy lower rates because the money is unsecured. This means that you cannot lose your property, and you can improve your credit rating as well. If you have poor credit, personal loans are an excellent choice because they do not require collateral, which is a big plus in the UAE.

Depending on your circumstances, a low credit score may be a good option. A good credit score is anything above 700. But if you are unsure of your credit score, it may be better to take out personal finance than to take on more debt. A bank’s decision is based on the amount of money you need and whether it will allow you to repay the loan early. You should also make sure you have enough money to cover the entire cost.

The process of applying for a personal loan in the UAE is easy as long as you have all the relevant documents and your AECB credit score is above 750. While applying for personal loans in UAE, it is important to consider the duration of the loan. For instance, if you need personal finance in UAE for a short period of time, you may prefer to choose a fixed-rate loan. If you need the money for longer, a fixed-rate scheme is more feasible.

The process is the same for all major banks and financial institutions in the UAE. The loan provider will transfer the amount to your account. You must be at least twenty-one years old to qualify. Some banks offer personal loans with low-interest rates, while others require that you have a minimum income of AED 5,000 thousand. You may also be required to submit a post-dated security cheque. In the UAE, the maximum amount of a personal loan is Dh1 million.

If you do not have a steady source of income, the UAE personal loan is the perfect option for you. If you have a stable job in the UAE and are earning an average of AED 5,000 per month, you can apply for a loan with the First Abu Dhabi Bank. In addition to UAE nationals, expats from all over the world can apply for personal loans in the country. They must also have a high salary of AED 5,000 a month.

Personal Loan in UAE 5000 Salary For Listed Company

Personal Loan in UAE 5000 Salary For Listed Company

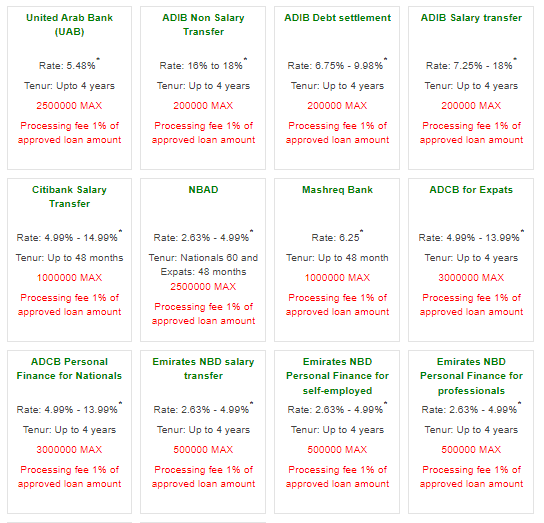

Best Banks in UAE for personal Loan

Best Banks in UAE for personal Loan

Citibank Ultima Credit Card is an outstanding facility

Citibank Ultima Credit Card is an outstanding facility

Calculate your EMI via Car Finance Calculator UAE

Calculate your EMI via Car Finance Calculator UAE

Manage your life with ADCB credit cards in UAE

Manage your life with ADCB credit cards in UAE

Salary Transfer Personal Loan in UAE - A Detailed Guide

Salary Transfer Personal Loan in UAE - A Detailed Guide

Loan Refinancing in the UAE: Improving Loan Terms

Loan Refinancing in the UAE: Improving Loan Terms

Benefits of Using a Loan Calculator Before Borrowing

Benefits of Using a Loan Calculator Before Borrowing

Top 10 Personal Loan That You Can Consider in UAE

Top 10 Personal Loan That You Can Consider in UAE

UAE: Residents to pay more for credit cards, loans in 2023 as interest rates set to rise

UAE: Residents to pay more for credit cards, loans in 2023 as interest rates set to rise