Emirates Loan is here to provide the best opportunities for Loans in UAE. We are providing you with our best services and financial products. Finance is the need for every person who wants to grow up in other countries and for locals to make a prosperous future. And in UAE, every ex-pat/ local finds suitable interest rates, desires loan tenures, and the highest loan amounts opportunity to make your dreams come true.

If you are planning to obtain a loan while staying in UAE, what are you waiting for? Just grab the chance and accept the outstanding Emirates loan offer, you will discover it the most promising recommendation throughout the UAE. Don’t worry your every loan requirement will be handled efficiently here, just come and tell us your specific demand related to the Emirates loan. We are serving our beloved customers with multiple kinds of loans according to their requirements.

Our Numerous kind of loans includes top-class personal loans, most famous Car loans, elite-class business loans, and well-managed mortgage loans. All these types are well categorized with their all conditions and regulations according to the banking constitution. If you want to know more details just visit our Emirate loan website and contact us. Every detail of the amount, interest (fixed, reducing ), processing fee, and repayment method with period will be given to you accurately.

We are here to assist you regarding loan services, For anything that may irritate you in terms of a loan, just call us. These amazing loan services are making our customers more satisfied and they like to get attached to us. Our Emirates loan financial services are available anytime for you, we welcome you to here if you are an ex-pat especially. Our non-resident clients are also much satisfied with us, they mostly love to obtain our loan because of the well-balanced structure.

looking for the easiest way to collect a loan without suffering the long wait in the rows of banks? Here you got a solution, apply for a loan within your own residence or at your job place. This is called an instant loan, a well-known category of emirate loans because it is the latest version in the world of financial services. Get our online instant loan in UAE which is an entirely shifted category of loan as compared to other loan services.

With the advancement of the world, the entire banking system also improved with the all-prevailing financial services. Now people depend upon the online loan category, which is an extensively more reliable and simplest source of getting any type of loan. Anyone who is familiar with its application method always likes to obtain a quick loan in time of need.

Instant loans in UAE will not impose strict conditions regarding paperwork. Just get that without much documentation process, you will surely love that because of its quick approval service. It may take you 10 to 15 minutes after which you will receive your loan confirmation message and the delivery will occur on the next day.

Emirates Loan is a company that is performing a bridge role between Expats/UAE natives. They are seeking Finance and Banking professionals who are willing to give loans. We have many emirates looking for the best or lowest interest rate loans in With the help of Emirates Loan, the chances of loan clients banks and financial companies are 99%.

When it’s about the key elements attached to online loans in UAE, these characteristics are the above level. Online loans can be of many types, you will see both legal and illegal loan providers in the online world. But you don’t have to trust any online private loan provider because you may face fraud in the online private loan sector.

Many cash providers are waiting for you in UAE, but you have to choose the most accurate lender for the loan. You should not waste your valuable time behind the private sector’s illegal and scammed lenders. Just adopt the legal way of banking and here you will make your loans safe and secure from scams. Save yourself and your family from the fake illegal and non-governmental agencies of loan providing. We are the loan providers in UAE, that going to attend to you in our proper legal and authentic way. Our company is entirely government-registered and working for many years to serve the nation of UAE with loan assistance.

Emirate loans are completely well-worth and well-known for the whole UAE. You have to be prepared with all the required information and with all the fundamental papers. Because here the identity of both individuals, the citizen, and the expat will require. We have to assure you that if you are an expat, then for how many months or years have you been living here? It will be the fundamental part of our inquiry process for all people applying for loans here. If you show your identity, we will also allow you the urgent cash loan in Dubai on behalf of your valid ID.

We are providing you with Banks/Financial-balances that are fulfilling your needs for Loans in Dubai. These banks are facilitating you with their services like Personal Loan in UAE, New and Old Car Loan, Home Mortgage Loan, Credit Cards, Business Loan, Insurance Policies, and Bank Accounts. So, whenever you need to create an account of any type just make a plan to visit here and create your new account. Similarly, auto finance will give you reasonable interest rates. we have brand new car loans that are also available with old, used car loans. So, do not waste your time too much thinking and reach us because we are the legal money lenders in Dubai.

A quick loan is our latest facility that will blow your mind because of its quick approval service. Through a quick loan, every process will be done so fast and you will not have to wait so long for the approval message. This service is opposite to the banking system, where you will have to wait for your turn. After that step, a long paper submission process will occur. But via this instant cash facility, you can even obtain an instant cash loan in 1 hour in Dubai. Yes, because most people call us and ask about this question. Let me inform you that, just give us your Emirates ID card and get this instant loan facility without any fear.

We have a staff of well-trained and well-mannered members that will never let you down at any point. If anyone calls us, they will quickly respond on the spot and listen to our beloved customer's needs. The style of their conversation is also very polite with every client and they work very efficiently in front of them. If you want to know the requirements associated with an instant cash loan in Abu Dhabi, our staff will instruct you. They will explain every detail from A to Z that you want to know about Abu Dhabi's instant cash loan. Even the exact location of branches will also tell you within UAE.

If you have any kind of query in your mind or even you want to know the branches address, you should call us. Our aim is to show you the right path and the right place where you can find your favorite services related to loans. Most of the people research on daily basis about the nearest branch or a branch that can be located within their hometown. For all those our beloved clients, we will give them special time to clear their minds about bank loans UAE. Also, we will give them information about all the nearest branches within their hometown with their proper address and location.

You may find here several lenders that will give you urgent money, but most of them are doing work without registering their companies. Stop making yourself foolish by their hands and remember this type of private lending is considered a severe crime here. Some people reach private institutions when they are not able to apply for loans in banks because of their low age and salary. But these privately working money lenders in UAE can harm you also, especially if you are late for their monthly repayment. You will also sacrifice your original ID, they will not return it to you.

If you will know the disadvantages attached to all these illegal loan providers, you will never trust them. First of all, they will not maintain your record and will not demand anything against the loan except your ID. They will carry your original Emirate identity card as security or proof of loan. Next, you have to give them the highest interest rates against your urgent cash loan in Dubai, which is again a bad idea. The worst thing is that, if you are not going to pay their installment for just one month, they may harm you. They may give you threats also and can take permanent custody of your emirate ID. So, you should be careful of such scammers and reach us for full safety, and secure instant cash loans.

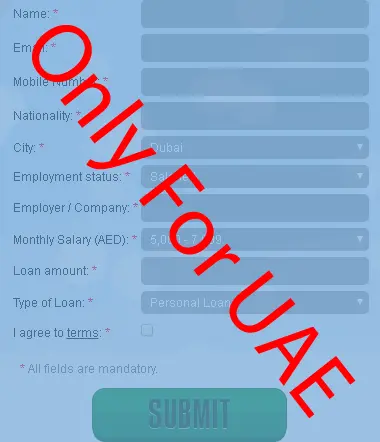

We always try to provide instant cash loans to our valuable customers, therefore we made our system convenient for easy and instant loans in United Arab Emirates UAE. To get these wonderful services you just fill out the simple form and click the submit button seeing above this page, and within minutes you will receive a matchless response. Our UAE loan services are free of cost, online, from the convenience of your home or workplace. Save on time, effort, and money by cutting through middlemen and long questions to find the best Finance for your needs.

Our requirements are not so much hard and fast as most people think, we are not doing incomplete work related to loans. We believe in accuracy and authenticity in every matter of loan, so you should trust us in this matter. Whether you are planning to obtain a formal bank loan or you want to apply for a quick cash loan in UAE, we will never neglect your dream.

We are offering a unique range of loans with different salary requirement packages. For example, the salary for personal loans is up to 5000, and for other loans vary with each other.

We demand your driving license if you are here to apply for our auto loan service.

Likewise, we offer our best business loan service on behalf of trading licenses especially. This is the fundamental thing, we cannot deal without your trading license.

If you are interested in our instant cash loan in 1 hour in Dubai, so make sure all your documents are genuine, otherwise, we may reject them.

If you're looking for a bank in the United Arab Emirates, then you've come to the right place. We have a list of banks in the UAE that includes all the major financial institutions as well as many foreign bank subsidiaries. The financial institutions listed are all affiliated with the UAE government, so if you're looking for a specific bank in the United Arab Emirates (UAE), you can browse through the following list. In addition to this, you can search the method of borrowing money online UAE through other similar banks to see their locations. You can also obtain their contact information with the exact locations in UAE.

An individual shouldn’t have to worry about the method and requirements of our loan services. We will never ignore you at any moment, we are always here to hear you. If you face any difficulty related to the loan just discuss it with us. Our efficient and active staff will explain everything in a good manner. Whether that thing will be about our formal way of loan taking or it will be our instant loan in UAE. Our calling numbers and the details are all mentioned on this website.

Visit the website https://www.emiratesloan.info/ and get your loan on the specific terms and conditions which you will find on the website.

A personal loan calculator is a vital tool when comparing credit cards and loans in the UAE. It provides important information about the terms and conditions of a loan, including the interest rate and down payment. It is essential to calculate these factors before entering into an agreement. The calculation may vary from bank to bank, so it is important to compare the charges and fees of different banks.

We made easy access to the money for you because we are Emirates Loan in Dubai UAE.

For Example, Mr. Sheiklh apply a loan of AED 100,000/- for 3 years and interest rate is 10% APR.

1-year interest will be = 10,000/- and 3-years interest will be = 30,000/-

Principle amount = 100,000/- Total interest = 30,000/-

Total amount payable in 3 years (36 month) = 130,000/-

Monthly installment will be = 3611.11/- Processing fee will 1% of Loan amount = 1000/-

Managing of monthly payments of numerous loans at the same time is a hectic task. That’s why the lenders suggest the way of debt consolidation to pay off all the debts instantly. As a result, you w

Read MoreWhen you decide to purchase any property in UAE, the use of your credit card is the most appropriate way. The credit card gives you money instantly that you will need for the purchasing of property.

Read MoreThe purchasing of a car in UAE is possible through the obtaining of car loans at lower interest rates. But before applying, every individual must ensure that the paperwork for this loan is easier. So

Read MoreWhen you decide to avail a personal loan in UAE, the lenders check different factors of eligibility. The eligibility also depends on the applicant’s income and employment. Therefore, the employees

Read More