To carry paper money is a little bit difficult and risky. A credit card replaces paper money with plastic money. Credit Card in UAE has too much benefit, first of all, it is easy to carry and the second one there is no risk to loss of money and many other benefits like online flight booking, online shopping, online billing, and some special discounts on shopping from different companies.so why are using cash money? The world is going to a digital era and in the banking field, Credit Card is made to facilitate you. A credit card makes your life easy while making a transaction. It builds your banking status good to get Loans from banks. Emirates loan is an easy way to get the best Credit Cards in Dubai from all the banks and financial institutes.

UAE is a place where you can find lots of variety in credit cards with many other financial products. A credit card is one of the finest financial products in the banking sector throughout the country. You will find out several kinds of credit cards with a variety of unique features. you can select the credit card in UAE according to your desire and need. We are probably here to help you in finding the best card that is suitable for you within UAE.

Finding the best card in Dubai or the whole UAE is not a problem now because of our accurate services to our beloved clients. People trust us in this matter and we will never let our clients down with our services. We always try to give you our best service and we will assist you in this case also. You will obtain the best credit card in UAE with the help of us and we always try hard to never disappoint you at any moment.

We are giving our adequate credit card services to achieve our goal related to our customer's satisfaction. Most of the Arabs touch us to find out the details about all kinds of cards that are commonly used in this region. Especially, they belong to the main hub of UAE, which means Dubai. We always suggest them the most famous and best credit card in Dubai. Whether they need to get that on an urgent basis or not, it will be always available to the all people of UAE.

When you obtain the credit card in Dubai or any other emirate of UAE, so it will not only the card but the happiness also. Because it will bring lots of happiness in your life due to it’s latest and unique Dubai credit card offers. These offers consists of many deals and suggestions related to the cashback, gift hampers, vouchers, free cinema tickets and much more things.

If you are a fun loving person plus you like to go on tours and some kind of adventures, it is meant for you.

you will be happy to have such credit cards in UAE with great qualities. Whenever you go outside on a tour or trip with such a credit card, it will surely facilitate you at that specific place. It will be useful during your vacations as well, you can avail the chance to get free tickets of movies at the cinema. Also, you can get discounts on your shopping in high-level shopping malls. Many cashback offers are also given to you to make your trip more attractive for you.

There are many other functions of these credit cards in UAE. you will not only obtain the various deals but the special services also you will get with it. With all these credit card offers in UAE, you will enjoy roadside assistance services also. This service will be beneficial in case of need during any emergency that occurs in the middle of the road. Through such a facility, you just call the bank and ask them to help out you. Any kind of help you can obtain like fuel recovery, car tire changing, etc. You can also ask for the towing vehicle service in case of need.

A credit card is such a thing that can be attained instantly as well, especially in UAE. Many banks are giving instant services related to every kind of card. Whatever the card you need according to your desire, the bank will provide it to you without taking too much time. Anyone can obtain the anytime an instant credit card in UAE, you just have to contact the bank before applying to get the info. Bank will give you the time for the arrangements of your card. You will receive it as soon as possible or on urgent basis as well.

As you know the features associated with these cards are amazing, in which cashback trait is also involved. Get your cash back via such a card while purchasing items within the range of UAE. The items you will purchase can be of any kind like heavy electronic items or they can be small products. Whatever the things you want to purchase, all shopping can happen via the best credit card in UAE for cash back. Holders are enjoying this cashback facility with many other special deals, offers, and gifts with their cards.

With the cashback and other several facilities, people also want the interest rate of card with reasonable prices. In Dubai, in fact, throughout the UAE you will see many popular banks that are serving the nation through this facility as well. So, if you are also looking for the most reasonable credit card interest rate in UAE, you reached the point. Where you will find your beloved credit card with your favorite and affordable rate of interest in UAE.

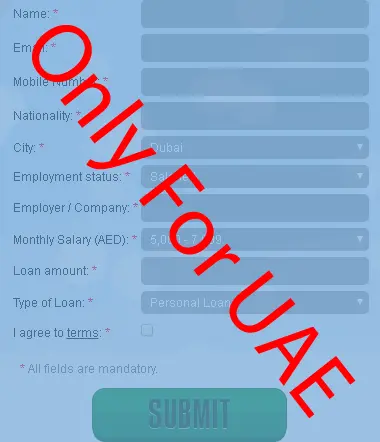

Now, credit cards can be obtained via the easiest and simplest way of the internet. The online procedure of applying for a card is getting popularity day by day and also considers the most convenient way of obtaining a card. In which, you will not have to face any far away traveling to find out the bank for such purpose. If you are planning to get that card, just open the website and apply there. Credit card apply online UAE service is always accessible and anytime available, you just have to visit the online various websites and web pages. Our fastest online approval service will blow your mind also, so grab the chance and apply for your favorite card within your home.

whenever you need to attain a credit card, make sure it should be suitable for your life. These cards will be able to improve your lifestyle through their different type of features. Getting a credit card in Dubai is not an issue but the easiest task. You just have to select the method before applying, that what would you like to prefer, the formal one or the online procedure. The bank will ask about your certain salary range and your age also. Because these things are essential and involved in the eligibility criteria for credit cards.

A credit card is issued by a company, usually a bank, to a consumer enabling the cardholder to pay for goods and services under an agreement between the consumer and the card-issuing company that the amount, plus other

agreed charges, will be paid later within the due date. Banks or other cashback credit card UAE issuing companies enter into an agreement with goods and services providing companies to accept their credit cards. Cardholders are required to pay that amount within the due date; else they will be charged with interest at a much higher rate. Credit Cards offer an easy way to track expenses, which is necessary for both personal expenditures and work-related expenditures for taxation and reimbursement purposes. Credit cards are available with a variety of credit limits, and repayment arrangements in almost all the countries e.g. UAE.

Business Credit Cards: Specialized credit cards issued in the name of a registered business and can only be used for business purposes.

Secured Credit Cards: A type of credit card secured by a deposit account owned by the cardholder.

Prepaid Cards: It is not a true credit card as no money is offered by the credit issuer. Cardholder spends money which has been priorly deposited by the cardholder.

Digital Cards: A digital virtual representation of any kind of identification card or payment card.

In this era of digital evolution, credit cards have facilitated transactions to a great extent. Carrying paper money is difficult and risky. Credit cards have now taken the place of paper money and made transactions so much easier. Additionally, they are robust, hence, does not take much space, and there is no risk of losing money. Especially, in the UAE, credit card Abu Dhabi contains great benefit as it allows people to make online transactions such as online flight booking, billing, shopping, etc. Also, it greatly increases your banking status to get loans from banks easily. Emirates Loans is perhaps the easiest way of getting credit cards in UAE from all the banks and financial institutes.