Emirates loan gives the concept of an online marketplace for personal loans, auto loans, and credit cards in the UAE. Through us, hundreds of consumers have benefited from our services. Today Emirates loan is considered by consumers as the only way to get an easy and hassle-free loan at a one-stop shop. That makes us one of the largest consumer services companies in the financial sector.

Who are Emirate Loans?

Emirates Loan is a company operating in the UAE striving to provide the best financial services and products. Emirates Loan bridges the gap between UAE/expert nationals and the banking professionals and brings them on a platform to choose from the best deals offered by UAE banks. Their team consists of well-qualified, professional bankers equipped with significant experience to aid all the individuals seeking to meet their financial needs. Apart from credit card service, Emirate Loans also provide services for different types of loans such as personal loans, car loans, business loan, and mortgage loan.

Pros of using Emirate Loans

Hundreds of consumers have registered with Emirate Loans because of the number of benefits they provide to them:

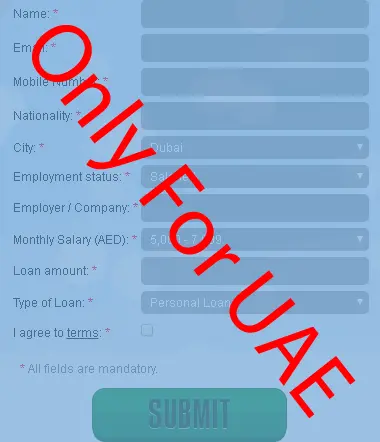

To avail of all these benefits, all you need to do is to go to their website and apply for a credit card simply by filling a form provided. After you have submitted your request, it will be evaluated and sent to relevant professionals. Within a matter of minutes, you will be contacted by the appropriate banking professionals to move with the procedure.

Visit the website https://www.emiratesloan.info/ and get your loan on the specific terms and condition which you will find on the website.